29+ mortgage vs home equity loan

Rates Are On The Rise. Web 30-year mortgage refinance increases 015.

The Mystery Of Us Banks Second Mortgage Exposure Financial Times

Lock In Your Rate Today.

. Web A loan to purchase a home is usually the first mortgage lien recorded on a property. Different home equity loan types - second mortgage vs home equity loanheloc vs. February 21 2023 0346 pm EST.

Different home equity loan types. Refinance Your Home Get Cash Out. Seniors can use reverse.

Web A homeowner owes 100000 on a first. Web As with all mortgages HELOC and home equity loan lenders will check your employment W-2s paystubs and debt-to-income ratio DTI to verify that you can. Find the Low Fixed Mortgage Rates in America.

Ad Trusted Reviews Trusted by 45000000. If you have an extremely low interest rate on your existing mortgage you probably sIf mortgage rates have dropped substantially since you took out your existing mortgageor if you need the money for purposes unrelated to your homeyou should consider a full mortgage refinance. A home equity line of credit or HELOC is another type of second mortgage loan.

Skip The Bank Save. Mortgage Cash-Out Refinance Interest Rates. Web Web Keeping the maximum 80 LTV ratio requirement in mind you may borrow up to an additional 60000 with a cash-out refinance.

Web Home Equity Loan vs. Compare Mortgage Refinance Options Today. Ad Save Time and Choose the Right Home Equity Offer for You.

Throughout the life of this loan 10 years in this case your mortgage interest rate will. Web Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice. Refinance Your Home Get Cash Out.

Web You can take a 15-year home equity loan for 87000 which will be distributed upfront and repaid over the next 10 years at 45 interest. Ad Low 10 15 30-Yr Rates 47 APR. Why Not Borrow from Yourself.

You can use the equity in your home. Written by Rebecca Lake CEPF for SmartAsset -. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Web Lets say that 10 years ago when you first purchased your home interest rates were 5 on your 30-year fixed-rate mortgage. Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs. This gives you a.

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. One alternative to using a mortgage to purchase a home is to pay with cash.

However with average home. Apply Now Get Pre Approved In a Min. Ad Apply Online For a Home Equity Loan.

2023s Best Home Equity Loan Comparison. Now in 2021 you can get a. Subsequent loans depend on the amount of owners equity in the home and generally.

Check Out the Best Lenders. If you refinance you can sav See more. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

If you have a median FICO of 680 or better you can access up to 75 of your equity. Learn About The Benefit of Cash Out Refinancing. Web Home equity and reverse mortgages are both ways to unlock home equity but reverse mortgages offer more protections to seniors.

Web Home Equity Loan. Get Free Quotes From USAs Best Lenders. 590 Rate 590 APR 5000 min 150000 max.

Ad Put Your Home Equity To Work Pay For Big Expenses. Leverage The Equity In Your Home With The Help Of WesBanco. Web A HELOC is a type of second mortgage that allows you to borrow money against the equity in your home as a line of credit.

The average 30-year fixed-refinance rate is 692 percent up 15 basis points compared with a week ago. Web A 10-year fixed-rate mortgage is similar to any other fixed-rate loan product. Web A home equity loan and HELOC allow you to borrow against the equity in your home and they function differently than a traditional mortgage.

Fixed-Rate 100 Home Equity Loan. Make Sure You Dont Overpay for Your Home Loan. 30 or 15 years.

Web Web 2 days agoReverse Mortgage vs Home Equity Line of Credit HELOC Which Is Right For You Are you unsure about a Reverse Mortgage vs Home Equity Line of Credit. Web 14 hours agoReverse Mortgage vs. Web 80 equity 60-180 month repayment terms.

10 15 or 20 years. 100 equity 60-180 month repayment. Web Alternatives to Mortgages and Home Equity Loans.

Like a home equity loan its secured by the. Learn About The Benefit of Cash Out Refinancing. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Compare Top Home Equity Loans and Save. Web Rocket Mortgage offers home equity loans with 10- or 20-year fixed terms.

Mortgage Vs Home Equity Loan Bankrate

Home Equity Loan Vs Home Equity Line Of Credit Heloc Equifax

:max_bytes(150000):strip_icc()/build-equity-315654_final-d5821108aaf04887820e3c0c9b176188.jpg)

Heloc Vs Home Equity Loan

Personal Loan Vs Home Equity Loan Discover

Home Equity Loan Vs Line Of Credit Which Is Right For You Tally

Home Equity Loan Vs Mortgage Key Differences Smartasset

Second Mortgage Vs Home Equity Loan Which Is Better Us Lending Co

Home Equity Loan Vs Mortgage Loan 5 Main Differences

Home Equity Loan Vs Purchase Mortgage Loan Discover Home Loans

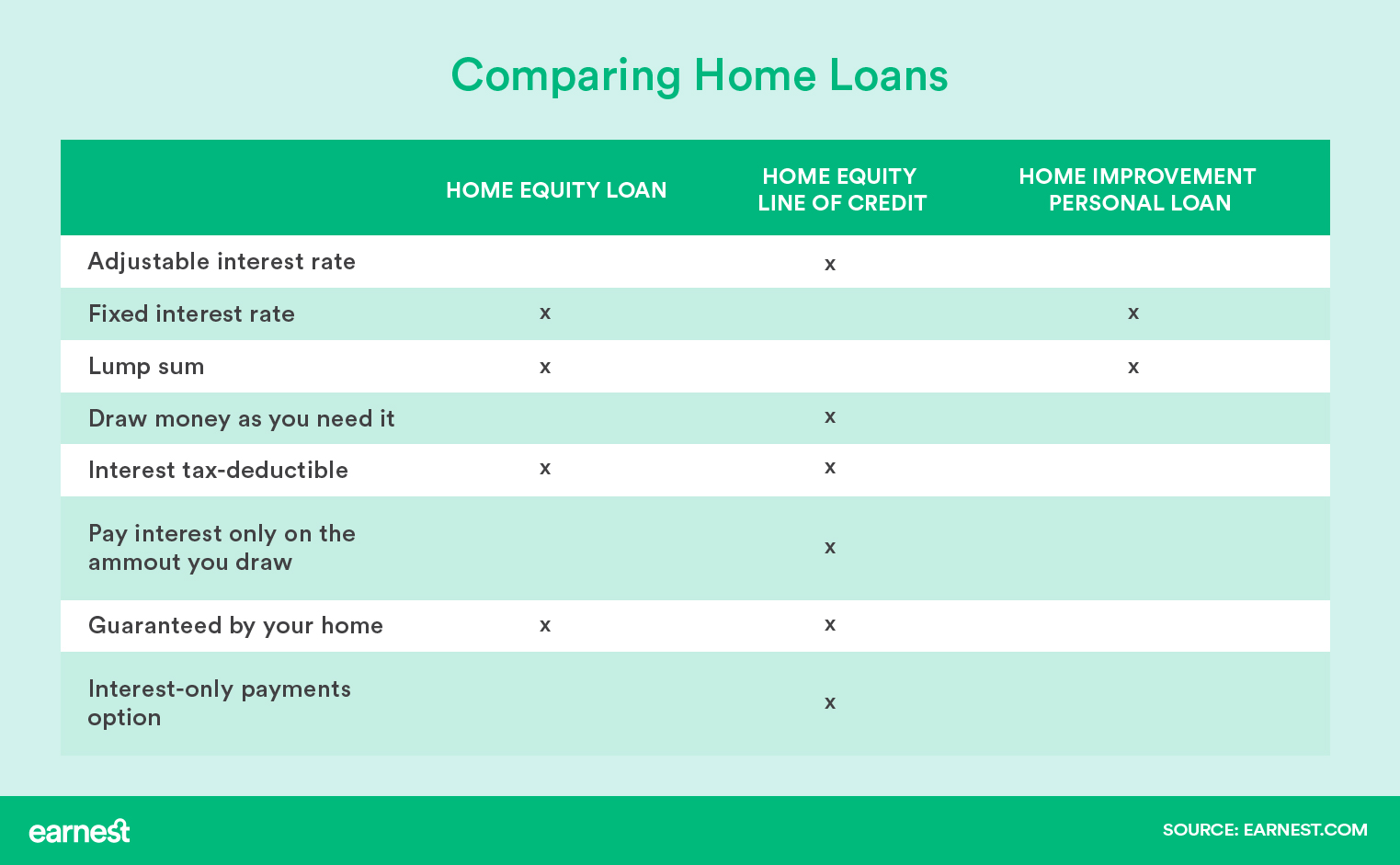

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Mortgage Apr Vs Interest Rate Top 7 Useful Differences To Learn

29 Of Homeowners Still Considering Heloc Or Refi Despite Historically High Interest Rates

Home Equity Loan What Is It Is This Kind Of Mortgage Right For You Marca

Home Equity Loan Vs Mortgage Loan 5 Main Differences

Home Equity Loan Vs Home Equity Line Of Credit Heloc Equifax

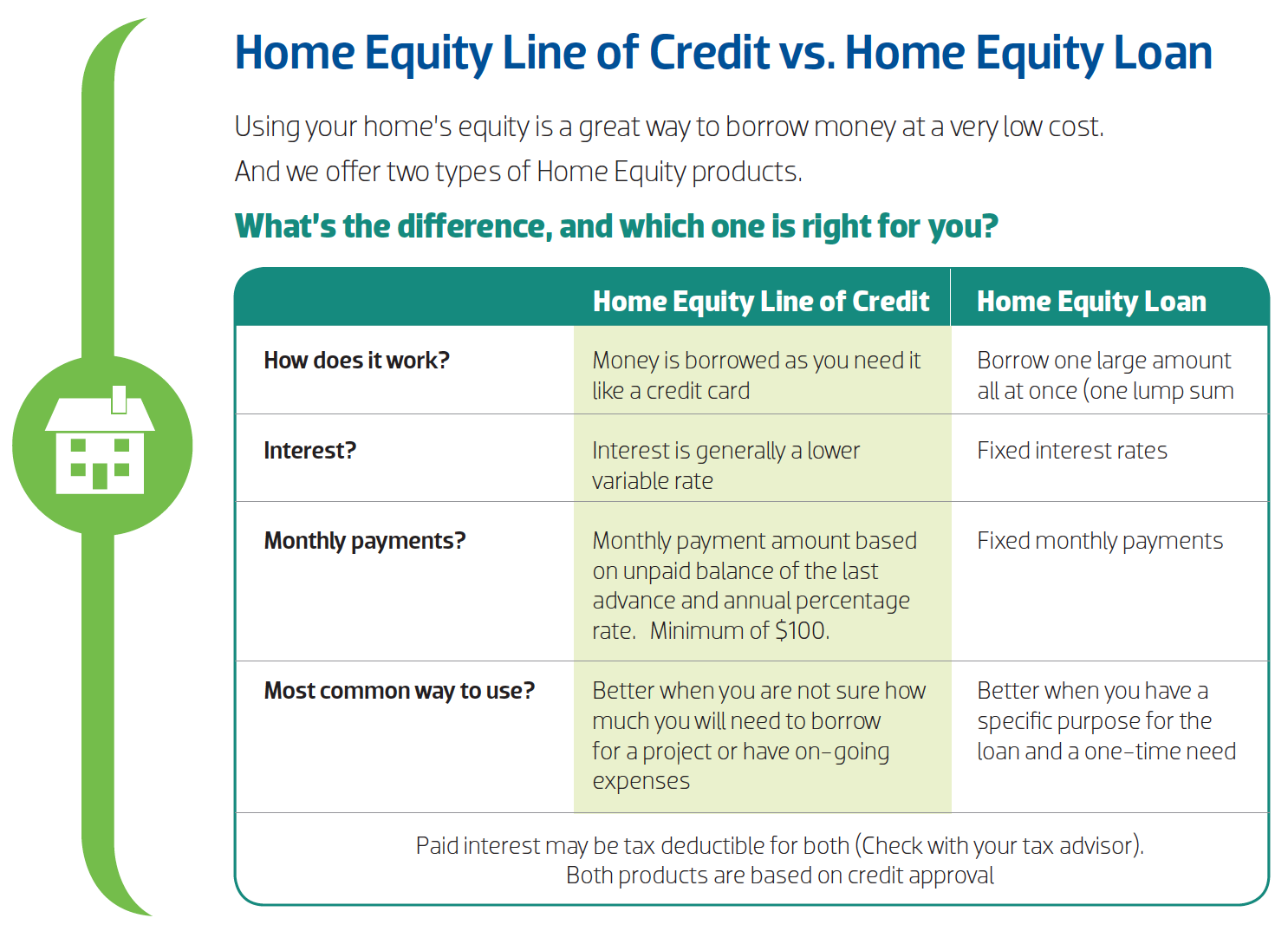

Home Equity Community 1st Credit Union

Faq Home Equity Solutions